WHAT'S ON MY MIND: Q3/Q4 2025

Riding the Exponential Curve

I’ve got one of those brains that just won’t shut the fuck off. Most see that as a curse—weed helps—but I’ve learned it’s just because I like to think. Especially about what matters to me: Transformation. Cannabis. Consumer. Markets. Leadership. Culture. The growth in the SUNDAY SESH community suggests these topics clearly matter to you too.

I’ve been consistent that I write—or tweet, or speak—not just to pay it forward, but because it selfishly forces me to go deep on my convictions. To poke and prod them. To make sure they’re durable and battle-tested. For both of us. I can handle L’s, but I can’t handle leading folks astray. So I do my best to think deeply about the issues I choose to surface.

And while thinking’s valuable, a playbook ready for action is where the magic lives—whether you’re allocating capital or allocating energy to build a better future.

While my quarterly “WHAT’S ON MY MIND” editions are my favorite to write, they’re also the hardest. For one, 90 days in cannabis is like 9 years. A lot changes, but too much stands still. And two, we’re barreling through the fastest pace of change our world has ever seen. The firehose—inside cannabis and out—is always on full blast. Filtering what’s worth sharing takes real intention. What you’ll read today is often rooted in ideas I’ve wrestled with for decades.

SUNDAY SESH is designed to cover a lot of ground. Definitely cannabis-leaning (duh), but framed within the broader consumer and investment landscape shaped by today’s transformational forces. On their own, the topics are distinct; together, they share a common theme: Change.

Some embrace it; some resist it. I urge you to do the former.

So with that, roll up a fat J, clear your head, and let’s dive into the SESH. Take your time, click through the links, and put this into context of past SUNDAY SESHES. Paying subs, drop questions in the comments—I read every one.

Let’s dive in.

1/UPDATE: SAFETY, SPIFFS & STUPIDITY

If you’ve been following along, the SSS framework isn’t just working — it’s massively outperforming.

The premise was simple: build a synthetic convert that captures (cheap) convexity while controlling downside. Sure, the S&P’s +35% since the April Tariff Tantrum — but if you’ve been allocating through this “SSS” lens, your returns should be higher. Way higher.

SAFETY: Keep a real bond floor. With short-term yields still ~4% (and heading lower), even near risk-free vehicles have delivered strong risk-adjusted returns. Treat this bucket as dry powder, not dead money — especially as risk-assets stretch and credit quietly cracks at the edges. And while it’s not viewed as a traditional “safe” asset, my Bitcoin exposure has materially increased. Why? Well, you know why. Overall, my Safety allocation has materially increased since last update.

SPIFFS: Use that carry to fund convex upside the Street keeps missing. If we’re living in exponential times, expect exponential winners. My X page remains the best way to stay updated. Cannabis remains part of the sleeve—still asymmetric, still mispriced. See below for more. Spiff exposure is about the same—less names, more concentration.

STUPIDITY: I said it last April during the storm— equity risk premiums can’t compress much further. “Beta” still scares the shit out of me, so I’m neutering it: shorting ETFs and companies I know (very) well that are just pissing in the wind. Since last update, I’ve also added select Big Tech and New Tech shorts. Will they hurt if the market still melts up? Yes, I don’t care—it’s the cost of doing business.

The framework works because it forces discipline—patient when it needs to be, bold when it counts. Best part? It’s mendable. You can’t buy my conviction, but you can borrow the framework to slot in your favorite SSS substitutes.

Pro tip: Don’t post your returns or pics of your AUM. No one cares. Stay humble.

2/MUCH TO BE THANKFUL FOR

This upcoming Danksgiving marks 30 years since my brother, cousins, and I went for what became our ritual “ice cream” break. That was the moment the seed was planted—the spark that sent me down the path to deeply understand this controversial plant, and where I began to imagine the transformational opportunity decades later.

If we’ve been Seshing for a while, you know Big Ideas Take Time. The same evolving cannabis thesis I underwrote nearly 30 years ago (eventual legalization, cannabis as a performance tool); 10 years ago (State-led “Green Wave”); and 5 years ago (Bifurcation, “Cannabis Stages Will Stack”) is largely tracking. Some parts are way ahead—bifurcation, ubiquity, normalization, hemp, beverages, and Republican adoption. But others are candidly worse—disunity, capital markets, valuations, and a still limited talent pool.

Here’s where we stand five years after I jumped in full-time as an investor and operator back in 2021:

In 2021, 71% of Americans lived in a legal medical state and 46% in a legal rec state with only 10 adult-use states. Today, over 80% of Americans live in a county with at least 1 dispensary in over 24 actively running adult-use markets in < 5 years.

When you add in hemp-derived, >90% of Americans have legal access to legal weed. States like TX, NC, TN, KY, AL, GA, LA, and IA still ban “adult-use” cannabis—but they allow hemp-derived products. Not to mention the plethora of websites that bypass archaic rules.

How far we’ve come.

Cannabis lived in the shadows for nearly 100 years. And 10 years post the launch of the U.S. Green Wave, I say we’re just getting started. Do not lose the forest for the trees. Stocks—especially ETFs like MSOS—do not always equal progress on the ground.

But the movement is alive, expanding, and mainstreaming faster than most realize.

3/DEMAND > POLICY

When asked five years ago when the Feds would finally pivot, I said I still had no clue. I still don’t, although the writing is clearly on the wall.

What I did say — internally here at TPB and in public — was that it simply doesn’t fucking matter. Demand always leads policy. And that once Reds steal the issue from Blues, it’s game over. You can’t regulate at the federal level until it reaches ubiquity. That’s what I was pounding the table on. We’re here.

I knew in my bones that cannabis would be everywhere — because of its efficacy, global preference over substitutes, and the unraveling of government lies. Ten thousand years of usage and modern science were always bound to converge.

Regardless of what the government does or does not do, cannabis as a mainstay is not turning back. Like every other transformational theme shaping culture, what we’ve seen so far is barely scratching the surface. High conviction.

And yes, that also includes select cannabis stocks too, you degenerates (🙋♂️). And yes, future new companies and subindustries have yet to be started. Also high conviction.

4/STAGES STACK: IT’S TIME TO MOVE

From my vantage, the same foundational thesis is alive and well. The hardest part is staying maniacally objective yet focused as the noise gets louder. Sometimes doing nothing is everything.

That said, I’m continually “tilting” the ship toward the next phase of cannabis. As I’ve said, Cannabis Stages Will Stack. Meaning, we’re at the point where the lines start to blur (i.e. hemp vs. cannabis) and companies will inevitably start to separate from the pack. As such, I want my bets to keep pace with those best prepared for the next phase.

I don’t have the space to recap my rolling thesis—maybe start here—so let me quickly summarize through the use of my personal cannabis bets inside a broader Safety, Spiffs & Stupidity framework.

TPB: For obvious reasons, I never talk publicly about TPB and our industry. Too close to home. All I say is that joining full-time was very lucky, but very intentional. It was a bet on a management-led transformation that needed help. But as importantly, it was a “safer” bet on cannabis ubiquity leveraging a product and an iconic brand that works regardless of store-type, cannabis flower prices, and regulations. In the 1980’s, if you were caught selling our main product—Zig-Zag—you could have landed in jail. Today, we’re on Times Square Billboards. Bigger picture, Big Tobacco vs. Big Food vs. Big Alcohol is still wildly mispriced. And yes, I’m still positioned as such.

GTI: A high quality—yet still cheap—way to capture many themes that matter. A highly focused and incentivized founder-led team; great capital allocators; highly-cash generative; optimized assets in states that matter; an iron-clad balance sheet to invest in growth (while peers are forced to pull back); and several shots on goal to thrive in tomorrow’s landscape. All at a very reasonable valuation, especially when you fold in RYM. Call it luck, call it skill—but GTI always seems to be in the states that matter, and this year’s Minnesota unlock will help buttress the decline in maturing states. Which, to be very clear, was what I underwrote re: price normalization like other smart folks. Hard to love GTI, but hard to hate them. And I’m still adding—no longer programmatically like H1, but on beta scares.

RYM: What GTI is doing with RYM is still not widely understood. Exactly where I like to live. How about something new? Low float, public names are all the rage these days. RYM only has ~2MM public shares. Said differently, there’s only ~$75MM of value available to fully express an isolated bet on hemp. I stand by my claim that there is a very realistic scenario where RYM’s market cap exceeds GTI’s. And potentially quickly. My favorite cannabis SPIFF tied to my favorite cannabis SAFETY (GTI).

GLASS HOUSE: By far the most controversial name in my portfolio, but ironically the one company that’s been underwritten by non-cannabis investors. I’ve expressed why I own Glass House in prior Seshes: formulaic growth with deep moats; run by a great team; exposed to both interstate and international commerce in both hemp and regulated cannabis. If we ever get functioning capital markets, my bet is that GH will dramatically outperform. And yes, Robinhood helps.

TRULIEVE: Paying subs know, but I did prune back this position. Afterall, it’s more than 2xed from Q1/April where I filled the boat. That said, this management clearly has a “secret sauce” operationally and a real competitive moat in Florida. At $8/share, you’re still only paying ~5x EBITDA—inclusive of the $525MM of uncertain tax liabilities offset by $480MM of cash. Yes, $380MM of notes mature next October, but Trulieve is a “safe-ish” way to play regulation. A good to have—not a must have—at these levels. On my short list, always.

CANADA: A microcosm of the global cannabis market roughly the size of California, Canadian LPs are often treated as liquid proxies for U.S. legalization. I think that’s a mistake. For one, the bifurcated winners north of the border have already found religion on capacity utilization—whether through forced shut-ins or smart, accretive M&A. And two, Canada is years ahead of the U.S. when it comes to redirecting excess supply into new export markets like Europe and Australia. Within the noise there are a few heavyweights quietly capitalizing on those shifts, with early U.S. footholds already in place. I’ve said before—and I’ll say again—SNDL is worth digging into. And now that it’s roughly 20% off the highs, it’s time to re-underwrite the story.

As always, this is not financial advice and utilizes all the same public information at your disposal. Know what you own.

5/TLDR—JUST GIVE ME A SUMMARY

Let me make the previous section very simple.

If you step back, I own in my judgement the best positioned MSO, the best pure-play on hemp, the best positioned public cultivator, one of the best operators geared for an eventual Florida rec flip, and one of the best positioned and highly liquid Canadian names. Quality first. Always.

I’m also short Big Food and Big Alcohol—but with less notional than before (because these names have been decimated and I’ve been harvesting). I’m also short select cannabis names like before to neuter some of the beta.

6/HUMANS CAN’T THINK NON-LINEARLY

If you follow my feed, you know I’ve got little patience for the grey-haired economists and legacy investors calling AI a “bubble”, crypto “pet rocks,” or claiming we’re overbuilt on data centers. Typically, the naysayers are the very same people who lack the curiosity to even try it.

I’m not saying shit is frothy—it is—but in many cases they are frothy because the curve is going straight up on top of the geopolitical forces decimating fiat. Like I said, humans can’t think non-linearly. They’re stuck viewing exponential shifts through linear frameworks built for a different era.

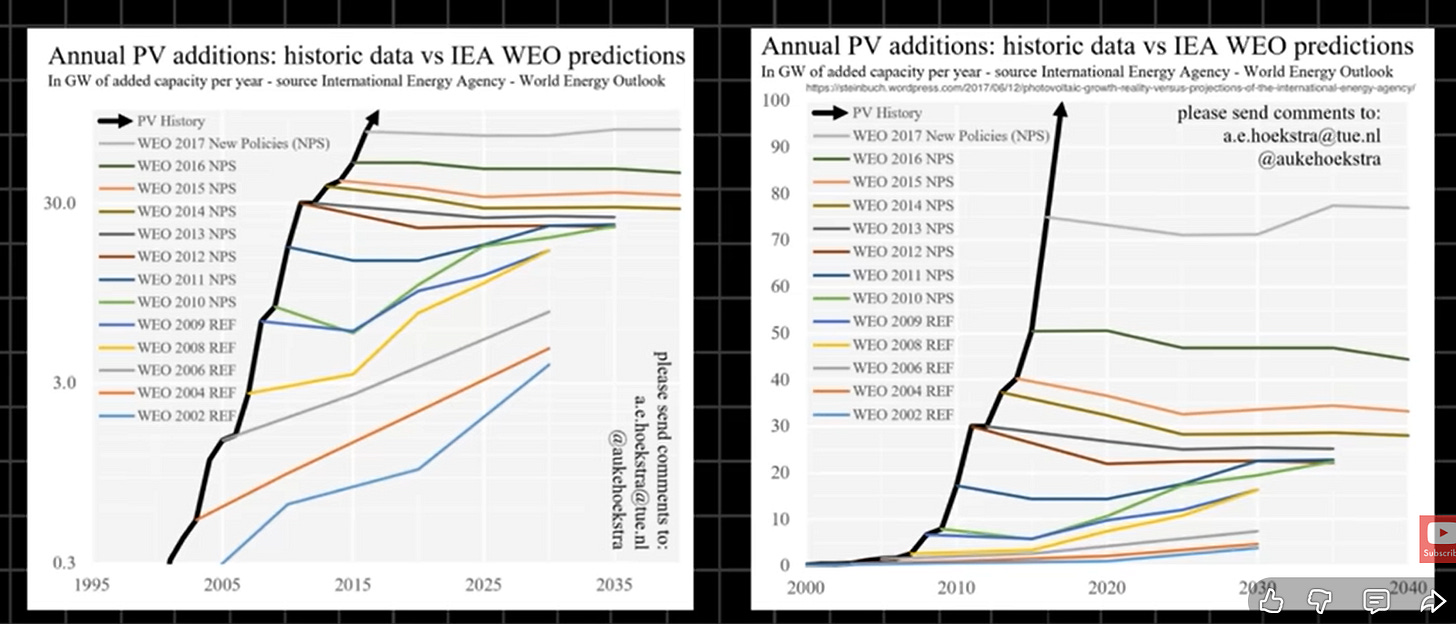

See the chart below from Peter Diamandis’ Moonshots podcast—it nails the idea. Year after year, the IEA projected neat, predictable solar growth while reality went vertical.

The analysts aren’t bad at math—they are limited by cognition and lack of curiosity.

(Btw, you should be devouring Moonshots—a must-watch if you want to keep your finger on the pulse of transformational forces—with realistic optimism).

7/CANNABIS IN MEDIA

One of the best gauges of normalization is watching how cannabis is making its way into mainstream media. In all instances cannabis today is a supporting actor—not the main headline like movies of the past, such as Cheech & Chong’s “Up In Smoke” or “Half Baked”—that showcased “stoners” doing stoner things. Sure, today’s characters aren’t devoid of character flaws—who isn’t?— but nevertheless showcasing cannabis in Hollywood is another signpost of global acceptance.

Here are a few top shows across major platforms that lit a match on how cannabis is becoming part of our social fabric:

Stick (Apple+): A washed-up pro golfer finds his old faithful pipe buried in his shed within the first 7 mins of episode 1.

White Lotus (HBO): Cannabis is a mainstay in both Season 1 (Hawaii) and Season 3 (Thailand). Yes, Thailand. OGs know, but Thailand + weed was a possible death sentence less than 6 years ago.

The Perfect Couple (Netflix): Actor Liev Schreiber enjoys smoking J’s rolled with RAW paper.

Sirens (Netflix): Peter a successful executive shares a joint on swanky Martha’s Vineyard.

Let’s just say it’s a far cry from MTV’s 1994 ground-breaking documentary "Straight Dope” that I personally couldn’t take my eyes off when I was 16 years old.

8/MAKE SURE YOU GET TO THE OTHER SIDE

We used to evolve in straight lines; now we’re living in exponential curves. Everything’s compounding—information, capital, technology, and noise. Can you feel it? I know I can.

That’s why taking care of the body and mind isn’t “wellness” anymore—it’s survival. The body’s the hardware that has to keep up with accelerating inputs; the mind’s the operating system that has to stay stable while the world spins faster. If you don’t build physical durability and mental presence, the speed of change will eat you alive.

With New Year’s around the corner, here are three easy life hacks I’ve implemented over the past 20 years that are worth sharing:

Meditation: I’ve said it before, but meditation is a superpower for high-performing athletes, executives, and investors. Doesn’t matter what technique you choose, but just find 5 mins a day. Best gift you can give yourself. I started doing it habitually in 2019 and haven’t looked back.

Stretching: The body wasn’t built for scrolls and chairs. Treat it like brushing your teeth. Two 5 minute sessions—morning and night. A decade later, I can confirm that consistency beats intensity.

Journaling: Men, get a journal. Get multiple journals. It’s not just for women anymore. I’ve been keeping journals my entire professional life of 25+ years. One for work to keep track of meetings and notes; and one for personal to keep track of my life. I plan on doing a deeper Sesh on this one topic—yes it’s that important.

9/ULTIMATE LIFE HACK

Any SUNDAY SESH wouldn’t be complete without a little cannabis recommendation. But instead of a strain or a brand, this one’s about an experience.

You do you—don’t sue me—but here’s my prescription especially for the road warriors out there juggling life, families, work, and purpose at full tilt:

Next Friday night, after a week on the grind, come home. Bring home flowers and dinner. Catch up with the kids and read to them before bed. Smoke a J. Go straight to your home gym. Push-ups, squats, pullups—whatever it takes to shake off the week. Then take a long, hot shower and finish ice cold. Stretch for five minutes. Connect with your partner, watch tv, read a book. And go to bed.

Cannabis is only “bad” if you make it bad.

10/QUOTE ON MY WALL THIS MONTH

“The measure of intelligence is the ability to change.”—Albert Einstein

To me, that’s the whole game. The world’s compounding faster than most people can even see—information, markets, tech, and even noise. You either evolve with it or get flattened by it. The pace isn’t slowing, and neither am I. You shouldn’t slow down either.

Independent thinking isn’t a flex, it’s a survival skill. Curiosity is the edge. Optimism is the weapon. The ability to adapt—really adapt—is the difference between staying relevant and becoming a relic.

I’ll always bet on the ones looking forward, not back. The future’s undefeated.

Onward,

SUNDAY SESH

***Disclaimer: Not financial advice, do your own work, no conflicts, my own opinions, cannabis used frequently in the authorship to face the pain and creatively solve problems. And, know what you own.