It’s that time again…let’s summarize what’s on my mind. Given it’s now 2025–where the hell did time go—this is a Sesh of reflection zooming in on cannabis (of course), but zooming out on the state of the world—business, investing, culture, consumer—to help inform my views.

Themes I obsess over…often in the quiet of the night, and often with a fat J right next to me (as if you needed me to tell you that). As always, I try to cut through the noise and pay it forward.

So roll up a doink, and enjoy the trip. As always, this one will burn a while.

NOTE: Like all SUNDAY SESHES, this is not meant to be digested in one bite. Rather, I’m giving you a rolling long-form narrative and access to critical themes I’ll talk about on Twitter/X so you can dig deeper and understand my perspectives. These Seshes help me as much as trying to help you…nothing in here is investment or financial advice. Any assertions made represents my opinion. Any positions or conflicts will be called out. Do your own work and “know what you own.”

2/DOWN THE FIELD

My goal for SUNDAY SESH is to give a unique perspective on the state of the industry, opportunities and risks, players and brands moving the needle, and how cannabis fits into the broader consumer and macro landscape.

All the while educating and normalizing cannabis whether you wear hoodies or suits.

Although I’m highly aligned as an operator and investor, Seshes aren’t “stonks” focused. Yes I’ll talk equities as needed to frame the narrative, and more broadly, how that narrative fits into the world at large.

3/MOVE THE NEEDLE:

I’m fortunate to help lead and invest in great brands that cut across cannabis channels in nearly every single market that matters—from legal to trap; cannabis to hemp; big to small; smokeshops to dispos; MSOs to SSOs; and everything in between. It’s not lost on me that my main product in my bag works irrespective of the price or type of flower inside, and that separation provides a unique lens.

I walk thousands of shelves every year in 20+ states, talking to customers and partners at every step to take the pulse. And canvas thousands of products, services, and brands targeting me as a partner, investor, and consumer across the hemp cannabis weed sector. I also am very lucky to have a consistent pipeline of companies seeking differentiated capital.

For me personally, I learn way more on the “no’s” than I do the “yes’s” and that’s just a hard reality of institutional investing.

4/PULSE CHECK

It was a long, strange year. Consistent with the bifurcation theme (yawn), it was a year of opposites. On one side, the hemp-derived market zipped thru starving for growth capital and “know-how”, while the “public” names faced torrid ridicule as sentiment (and stock prices) deflated along with political reform.

Said before, but it’s ironic (and devastating) that a tiny sliver of the equity with negligible liquidity is controlling the narrative of tens of billions in the capital stack, tens of billions of TAM, millions of consumers, and ~500K over-worked teammates putting their careers and lives on the line.

If there’s something we can all agree on, it’s that we just couldn’t catch our breath all year. The world spun faster this year in/out of cannabis, with content from all spigots and flywheels on full blast certainly not helping our zen.

It’s literally signal vs. noise all day, every day.

From chasing down the next opportunity, to putting out fires. Seeing growth in new markets, while mitigating the maturity curve in others. On the reg.

Throw in a little legal stop-and-go (looking at you Dems), and hemp stupidity (looking at you Repubs) it becomes a year of tug-of-war. And a year of tremendous uncertainty. Don’t know about you, but I finished ‘24 fucking exhausted.

My advice? Turn the page. It’s never as bad as it seems. And it’s never as good as it seems. It just…is. Accept it, but don’t succumb to it.

You might even want to experiment with the very product you’re selling (ahem), not to “numb” your pain (stupid prohibitionist view), but rather a tool to deal with your reality with compassion, ingenuity, and objectivity to move forward and solve problems.

Cannabis is a performance tool.

No I’m not a doctor, so “you do you” and don’t sue me.

5/H2 POLITICS TRUMPS H1 EARNINGS

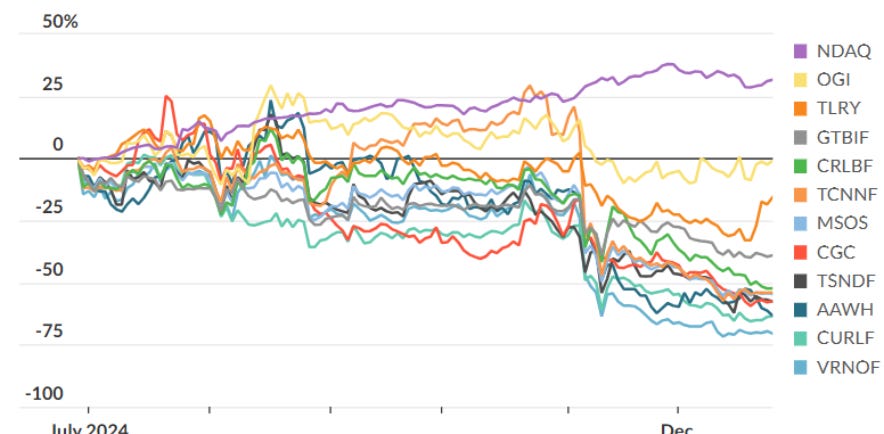

But here we are nevertheless…with the MSOS -50% in FY’24 (after a flat FY’23) where H1 outperformance reversed hard in H2 (really Q4) as another political dagger (Florida) contributed to a H2 -45% mudslide. Names most exposed got murdered…for many idiosyncratic (read: balance sheet, liquidity, earnings power) and systematic (read: 280E, SAFE, V3) reasons. Some investors waved the “get me the fuck out now” flag which is how companies (like $AAWH) got to buy stock well below bid into New Year.

6/BIFURCATION→STACKING

Been banging the drum over the past 3+ years that “quality” will empower the “strong to get stronger” as the entire value chain continues to “bifurcate” leading to “lifecycle stacking” as potential winners hoover those less fortunate. To be clear, those potential winners will endure deep battle scars in doing so.

Last Sesh I revealed I was becoming bored with the “bifurcation” thesis, and now you see why—it’s pretty consensus and I’m already down the field…some of you are as well.

I rarely talk canna stocks for so many reasons but I’ve been clear I’ve only owned “quality”, not beta/ETFs, and on occasion will make calls on the overall sector (i.e. pre-HHS, Post-HHS, Q2->Q3 pre-Vote 3).

No change here, but for the first time in 5+ years I find myself picking over rocks as the entire sector is literally decimated. I’m more than less intrigued by what I find.

7/STACK ‘EM

My June/Q2 Sesh revealed a new theme to readers: cannabis evolution stages will “stack.” Regulatory always trumps, but we saw in Q4:

Consolidation/M&A (Cansortium/RIV; Cannabist/Florida divest; Terrascend/Ohio; Organigram/Motif to name a few);

Shut-ins/exits/defaults (Eaze; Pharmacann/$IIPR; continued CA cultivation, MSO state exits);

Several capital structure tweaks from VC to refi’s to buybacks and pretty much everything in-between; and

Inevitable “toe-dip” into hemp-derived by licensed operators (Curaleaf, GTI, Tilray to name a few).

8/STRONG GOT STRONGER

My go-to theme for 2024 was the “strong will get stronger”, even if the public market didn’t notice or care (FYI: the private market most definitely did).

But even the few potential “bifurcated” winners suffered blows despite steady execution.

Let’s take Green Thumb Industries ($GTBIF), a consensus favorite and a long-term holding.

$GTI thru LTM Q3 grew revenue +6% and EBITDA +12% running the track with blinders. YTD:

Gross margins grew every quarter (despite universal price degradation) and invested more in its brands

Delevered ~$60MM (net) and got repaid ~$25MM in Nov from its Cansortium debt

Bought $73MM stock ($33MM in FY’24 thru Q3)

Threw a “dollar yo!” $10-20MM hemp chip down on $AGFY (which has ~10xed mark-to-market at peak) providing tremendous optionality; and

Refied its looming $225MM April 2025 notes extending the runway for years

As it continues to print cash and stay current on taxes. To do that requires tremendous cross-function synchronization.

When Ben says “focus”... this is what I think he means.

9/BUT THE MARKET IS THE MARKET

Despite this progress (granted rearview), $GTBIF from March highs lost ~4.5x LTM EBITDA turns going from 10x and now sits at ~5x trailing. Add in 280E that should “cut our tax bill in half or so” (Q4’23 call), and capex going from ~$220MM in FY’23 to ~$80MM (of which near majority is growth capex), we’re now looking at FCF yields in the low teens for a biz that’s <.70 levered on a gross basis, and <.25x net. Said differently, investors are clipping mid-teens unlevered FCF yield. Odd.

Worth pointing out that senior creditors (~.25x net thru the stack) are commanding ~8% yields.

To me, much of GTI’s equity risk is truly credit risk–which means $GTI should benefit from a) future cheaper cost of capital; and b) mispriced convexity with significant duration with a lot of “kinetic energy.” In this case, convexity exposed to i) benefits of patient capital to play offense and defense; and ii) regulatory reform, which likely can’t get any worse (but non a non-zero prob). You are definitely long risk that: i) mgmt will continue to be great stewards of capital; and ii) the waters will be choppy.

I stand by my view that the equity for quality is cheap given its (relative) stability with the prospect of reform. And plenty of bullets to play offense in the event reform continues to lag the real world. While hard to see the multiple materially compressing further, quality can definitely get cheaper (with no fresh capital) so be prepared for that.

10/CURE FOR CURALEAF?

I find it odd Xverse doesn’t really debate $CURLF much–either bull or bear. Consensus seems to believe its scale, state diversity, and increasingly European exposure are big advantages, but man did the Street not care at all this year. Remarkably, Curaleaf’s stock is off ~65% this year with a market cap just shy of ~$1.1BN. Yet, Curaleaf EBITDA is actually up this year on slightly growing revenue (let’s just talk LTM to be objective)…

11/CREDIT DRIVES EQUITY

…Most of $CURLF move in ‘24 was multiple compression–going from “top dog” trading at ~12x at the start of ‘24, now ~6x. Debt slightly down, but tax liabilities markedly higher (~1.2x). Capex +30% as expands into Europe. But kick in “over $150 MM” in 280E taxes and assume more normalized D&A/capex, now we’re at ~4x (if you believe EBITDA is somewhat sticky). Still trades at a premium ex 280E (hmm), will need to further invest, and Boris returning to grab the wheel gives many heartburn. But one of the cheaper names post 280E (if and only if).

The $460MM Dec 2026 Notes are the watch-out, but I think the more annoying overhang in short-term is the residual $60MM Bloom 2025 payment (and potential dilution) that comes due this month. You’d think, based on precedent Bloom deal recuts, that cooler minds will prevail.

My strong view is watch the credit. Equity ALWAYS follows the credit.

Here’s a look at Curaleaf starting and ending the year, and how I’d think about PF for 280E and how that ripples thru valuation and its FCF/EBITDA.

12/D9 BACKDOOR, BORIS?

Boris made news after Florida’s V3 failed by saying that the Farm Bill is the most important near-term catalyst. I tend to agree. He also said of the 3 logical outcomes, regulating D9 is a “backdoor to full legalization.” This is where I just don’t know today. Too many unanswered questions. And I’m not convinced Curaleaf knows (or can afford) an “all in” approach. We shall see.

On top of tax arb, hemp’s ability to distribute interstate and utilize existing infrastructure (rail, LTL, distributors, DTC) is a bigger issue for limited-license operators. Yeah, state regulators will do their best to tap it down (definitely working in NYC, Missouri, CA) but interstate is the lynchpin to figure out.

Why? For another sesh, but my strong view is that we’re not growing enough cannabis domestically to satisfy total demand…but we’re growing too much weed in certain states to satisfy its own state demand. More on this in later…

13/INTER-COUNTRY???

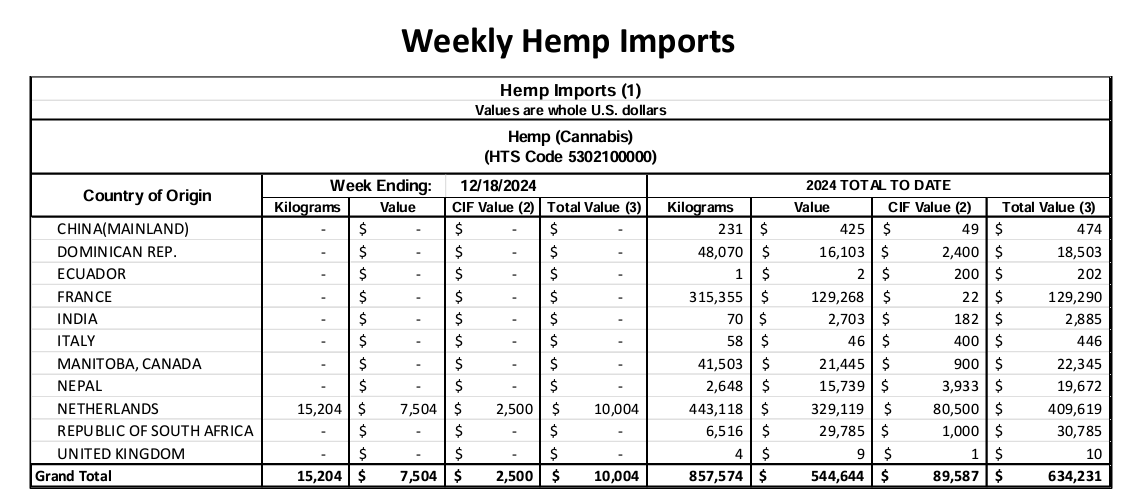

And don’t forget inter-country. Just look below–to date in 2024 we’ve imported nearly 435 tons of hemp from the Dutch. To put that into perspective, you’d need a 7.5MM sq ft facility (at ~60 grams/yield/sqft). Or about 1.5x the size of Glass House. At basement prices—do the math. Like I said, this shit is global.

Now I’m not saying Dutch hemp is making our way into our favorite intoxicating beverages (hmm), but it most certainly will influence the input costs of CPG products where THC/A is an ingredient, or at least contribute to stability. Very good for the bev biz, and very good for (real) brands throughout the cannabis landscape (yes, even flower). And exactly in line with my thesis.

14/THC IS AN INGREDIENT

THC as an ingredient continues to decline, especially as states mature, less incremental buyers as state borders become less relevant, and of course hemp competition. The question is whether the grower, brand, manufacturer, distributor or store will benefit. MSOs are all-of-the-above. Some brands are all-of-the above.

The biggest existential risk?: Is cannabis more akin to a strawberry or is it an input where finished products can command value over the commodity inputs. Nearly everything we value outside of cannabis does the latter. My bet is cannabis will be no different.

Proof today is that some jars I paid for this year were 3-4x the cost of the lowest 1/8th on the shelf, especially in CA as the shelf bifurcates. I personally didn’t blink–I know what I want to put in my body and an <$15 experience is a steal (in relative space vs. say alcohol).

15/DON’T BE IN THE COMMODITY BUSINESS

TLDR: Don’t be in the commodity business unless the product you’re selling is a commodity at scale

The nat’l average $4 beer contains <$.20 of ethyl alcohol input costs at 5% ABV (<5% COGS)

$8 pack of 20 cigarettes (pre-tax) contains <$.75 of tobacco (<10% COGS)

$2 cup of coffee contains <$.10 of coffee beans (<2% COGS)

$14 pill of branded Lipitor contains <$.005 of atorvastatin API (<1% COGS)

Take-away: All of the leading brands in these categories use the “ingredient” to sell a differentiated “quality” experience. Once again, “quality” does not = highest priced on shelf but rather “delivering value beyond the perceived value proposition”

16/DON’T BE IN THE COMMODITY BUSINESS…UNLESS YOU’RE A GLASS HOUSE

A new one for Sunday Sesh print, but one we’ve been closely watching for years is Glass House ($GLASF). As solid team as they come both in and out of the office. They’ve got the scars and the passion. Hat’s off, truly.

Below is Glass House’s cost per pound over time. Study that chart.

Team said since early days they could get costs down to $100/lb and we’ve already seen $103/lb (Q3). Think about that folks. That translates into <$1 an 1/8th of flower. A 1 gram joint? <$.25. Not only cost, but cost at scale. Just imagine growing 232K pounds in a quarter. That’s 116 tons, or ~30 MILLION 1/8th flower jars. It would take 8+ YEARS for a 50K sq ft indoor grow to grow this much weed. (Note: assumes 65 grams/ft with 8 wk cycles).

You want to compete against that?

17/HOUSE OF GLASS?

Objectively, one potential watch-out is the capital structure incentivizes gross profit dollars over margin. More, Q4 gross margins are expected to be down ~600 bps yoy as Glasshouse “sniffs out” where the market clearing price can go.

While debt is manageable especially given the cash (and cash flow) position, the prefs carry onerous 20%+ dividends of which a meaningful portion is paid in cash with escalators. And this sits behind a credit facility that matures Nov 2026.

For Glass House, hemp-derived can’t come soon enough as it will provide another valuable “off-ramp” for cheap biomass while stabilizing legal weed. Ideally, inter-state. And if somehow they can create/buy brand equity with their consumer-facing jars, then look the fuck out. I expect them to lean in here. Winning flower competitions and growing winners like their Lilac Diesel will help.

If you missed this meteoric rise in ‘24, put this one on your short list for the inevitable beta stupidity especially after the ATM taps out.

18/GOT FLORIDA? NO, FLORIDA GOT ME

Last Sesh I made it very clear that H2 earnings will likely get murky after 2 incredible quarters that the Street missed. While Q3 earnings went as expected, possible regulatory change—namely Florida—would drive the narrative for Q4 and beyond. Any Florida wobble would likely create a downward spiral where “speculators” would become spooked leading “investors” to question the path forward. No better way to pick at this thread than looking at Trulieve ($TCNNF).

And that’s a damn shame because I think that team especially Kim massively took one for the team.

Here’s where I personally had thesis drift, and I own that. As I suggested previously, the “deal break” nature of Vote3 blew thru rational downside (which I pegged at $7 or ~4x EBITDA), and the forced selling continued till year end.

My view: too cheap

19/LIFE THESIS: CONTENT IS NOT KING

Let’s zoom out. First, Gates and Murdoch and Iger are simply wrong–content is not king–and it’s been my “north star” in consumer investing for over 15 years. (You should have seen the looks I received inside Board rooms and Investment Committees arguing this. I was very right, they were very wrong).

In a nutshell, as content became democratized, ubiquitous, and less moated, it would be far more important to match great content (“product”) with great distribution (“how your product gets to consumers”) where incumbents were simply not safe and we’d see enormous flywheels start to crank.

Incredibly rare, but if you squint hard there are a few diamonds throughout consumer who nail it and are handsomely rewarded.

Getting either wrong is a dagger today. See $NKE—still world-class content but now highly-confused distribution. See $SBUX—still world-class distribution (40K stores) but now a highly-confused product and customer experience. Both companies are experiencing severe pain for very different reasons. And the fix for both will be harder and longer than what consensus thinks, regardless of who is now driving the bus.

TLDR: Brands that don’t give customers (and partners) a reason to stay loyal are in deep shit.

20/HUMANS CAN’T THINK NON-LINEARLY

Let’s call it straight: humans simply can’t think exponentially. Most in the today’s casino stock market has no idea what that even means. But I’d argue today’s 20-30 year olds are waaaay better than their slower elders. And many elders who can do it, work in jobs where the next milestone is a simply a quarter away.

Don’t get me wrong—calling quarters matters—but calling the transformational trend and thinking in years or decades matters way the fuck more. Learn how to do that.

21/ BETA SCARES THE FUCK OUT OF ME

Can’t say I’ve seen markets like this over 30 years. I was trading in my college dormroom in ‘98 during DotCom…and this feels very different. It’s very bipolar. During DotCom, everything ripped and rippled thru the entire Nasdaq 1000 every day. This time, I see a relentless hoarding of “tomorrow’s” companies. Valuations are so stretched across the board, but the market is incredibly biased on what companies will survive. And compound at ridiculous rates while creating “never been seen” moats…while pummeling (or ignoring) companies that are perceived to be left behind. Leverage is in vogue again, customer behavior has also bifurcated, but like a swarm of bees, they “attack” each nihilistic opportunity swarming it for short bursts of time. Gamestop. Memecoins. AI. Bitcoin. Quantum Computing.

Great time to be a stock-picker.

22/KNOW WHAT YOU OWN

Here’s the lesson from the last 2 points:

We simply can’t understand why Bitcoin or MSTR 0.00%↑ or NVDA 0.00%↑ or SPOT 0.00%↑ or AAPL 0.00%↑ or META 0.00%↑ or AMZN 0.00%↑ can go straight up because our lens is just too god damn short. Think bigger. They might be “pulling forward” demand (i.e. overvalued), but man this is where it’s going. Isn’t that blatantly obvious to you?

Know What You Own: As beta—especially mkt weighted ETFs like QQQ—further concentrate in the handful of names, I recommend having at least a good understanding of what the top 10-20 names do as if you own them in size. Because you likely do.

23/LEMONS → LEMONADE

Back to weed. The best companies turn problems into opportunities. Case in point: Catalyst and their outspoken leader Elliot Lewis. Man do I applaud their moves this year. They took on the LA times article head on, and realized providing safe and accessible weed to its customers is priority #1. Catalyst put a spotlight on the issue and leveraged the supply chain to clean up its act. On their dime. Doing the gov’t’s intended job. Simple quid pro quo. But not shrouded in evil, but for us the consumer. Masterful.

24/ BRANDS DO MATTER (Whether You Believe Me Or Not I Don’t Care)

Alien Labs: I think of forward-thinking, fun, high-quality flower, counterculture

Old Pal: vintage, easier times, smoking bud with your pals (disclaimer: investor)

Puffco: innovation, clean, approachable, hash

Doja: exclusive, exotic, quality, global style

Wana: consistent, reliable, sleep medicine

Rythm: music, vibes, mass quality

Stiizy: street, urban, LA, ubiquitous

Sunburn: Either a) smuggling pounds down the Florida interchange (blazed), or maybe at a beach BBQ in Key West (again blazed)

Catalyst: “weed for the people”

Cann: Delicious weed you can drink hangover free

I literally can go on and on, by form factor, by state/region, by legal/trap. Here’s the point: Brands are working. You just might not notice it. If you don’t…or worse are struggling to clearly articulate your own brand and how it stands out, I would challenge you to deeply ask why. None of these brands above had real capital to build the brand…

It happened thru authenticity, consumer trial and adoption, nimble business models that work at scale, competitive edge (“own a lane”) with a clear strategic roadmap, innovative and brave leaders at the front, incentivized and aligned workforce behind, valued partnerships across the chain, and a lil’ bit of hustle from top to bottom.

Of the thousands of brands I’ve seen come and go, and of the standouts of today, above is a decent recipe for success. Copy that.

25/GENETIC INTEGRITY

Regardless of “strain name” game, I believe brands have an obligation to tell you the story of how this flower came to be. Who were its parents? Why did the breeder select them? How were the genetics sourced? Why was this pheno selected? What makes it unique? Is it clean?

Best-in-class consumer co’s bring you on a journey of how this product you’re about to enjoy (and judge) came to be. Sometimes even the story drives the experience. Think sun-kissed cabernet grapes basking in the California sun and then cooled by misty ocean breezes to become delicious Napa Valley cabs. You expect something special before you take a sip. And when you take a sip, it’s self-reinforcing.

Cannabis growers/brands are more akin to a chef or artist than a “cog” in an industrial ag wheel. Farmer Joe at the farmer’s market vs. a half-ripe cardboard tomato at the supermarket. Whether it’s produce or music, we all gladly pay for art than for commodities. Don’t confuse the two.

Cannabis brands…get there. If you can’t tell me why this batch or grower or pen or bong or paper is truly special…then save your money until you can.

26/SECRET SAUCE

And if you’re keeping the recipe to your chest, be intentional about it. It’s like a secret recipe–and we get that. But then tell me why it’s a special secret. Talk about the brand ethos. The selection ethos. The judging ethos. Alien and Connected are masters at this. Doja too. Rythm really made some strides this year. Puffco, masters of making something so complex (hash and old-school methods of enjoying it) to create a product that’s elegant, simple that’s playful and normal.

Companies have been forced to press gas on a “new drop” whether it’s cannabis brands or accessories or anything really in consumer. Point is, it’s hard to get someone’s attention. Content is exploding, folks are juggling more than ever, work’s piling up as we downsize, and world is on fire.

For weed, take a page from Ted and the Alien team or Puffco to see how they create stories. Or if you can’t afford it, let your audience get to know you. The why behind your story.

27/THINGS I WISH PEOPLE KNEW ABOUT CANNABIS (EVEN PEOPLE WHO CONSUME CANNABIS):

Hotter the temp, higher you get.

Cannabis for anti viral / head cold–wild we still don’t talk about this yet

Head over to Stashtips for more. I have high hopes for that one, one day I hope to have more time because there seems to be a real need for real education in a non “yo bro, I was smoking weed out of a soda can” way.

28/STRAINS OF THE YEAR

Last year I predicted the return of OGs, the sours and the rest of the legacy strains that were being masked by today’s candy consumer. And boy did we see that this year. Almost everything I enjoyed in ‘24 was really well-grown older strains or new-meets-old school crosses. My top 5 fav jars in 2024:

Gary Payton // Smokey Bodega (NY) (Y x Snowman)

Birria // Life Is Not Grape (CA) (OGK x Zkittlez x Sherbanger)

Zazul // 516 Hort (NY) (Zkittlez x Planet Purple, PP is Sherb x Dosido x Z)

Helium// Doja (FL) (Z x OGK)

Zpectrum // Alien Labs (CA) (RS-11 x Z#22 )

29/QUOTE ON MY WALL THIS MONTH:

We can all get stronger at the “broken places.” Don’t give up, and above all else, don’t fucking give up on yourself. Keep moving forward. And bring people along with you.

I hope you enjoyed this SUNDAY SESH, and welcome to Substack. As always, questions, comments and feedback welcome.

Onward,

SUNDAY SESH